Biden Receives Backlash for Tax Plan That Benefits ‘White’ People

Joe Biden has recently outlined his 2025 budget proposal, which includes cracking down on long-term capital gains.

However, many have criticized this proposal, saying that it disproportionately benefits white people.

Joe Biden’s America Has One of the Highest Inflation Rates

Trying to get America’s finances under control isn’t exactly Biden’s forté and is something he has struggled with over the last four years.

Source: The White House/Wikimedia Commons

Biden’s inflation has been at an average of 5.7%, in contrast to Trump’s, which was an average of 1.9%.

Biden Is Increasing the Top Capital Gains Tax Rate

Biden’s 2025 budget proposal outlined his plans to increase the top capital gains tax rate.

Source: Michael Stokes/Wikimedia Commons

This tax rate is currently at 20%, but should the proposal go ahead, it will be at 44.6%.

What Are Capital Gains Taxes?

Capital gains taxes are taxes on many things, often from people’s investments.

Source: Alena Darmel/Pexels

These taxes are only applied once the investments have been sold and include stocks, bonds, and real estate.

Tax Rates Disproportionately Benefit White Taxpayers

These tax rates have been hiked as the current tax rates disproportionately benefit white taxpayers.

Source: Kelly Sikkema/Unsplash

The majority of white taxpayers currently tend to benefit from reduced tax rates, which the Biden administration wants to change to make taxes more inclusive.

Taxable Income of $1 Million

These rates will only affect taxpayers who have a taxable income of $1 million.

Source: Olga DeLawrence/Unsplash

Those with taxable incomes of $1 million and over are considered to have the highest capital gains.

Reducing the Federal Deficit by $3 Trillion

One of the Biden administration’s main aims is to reduce the federal deficit by $3 trillion.

Source: Freepik/Freepik

They will do this by imposing a 25% minimum tax rate on the unrealized income of the wealthiest households in the US.

Other US Tax Rates Are Going Up

As a part of Biden’s plans, other tax rates in the US are set to go up to help reduce the federal deficit.

Source: RoboAdvisor/Pixabay

This includes raising the taxes for billion-dollar companies from 15% to 21% and raising the broader corporate tax rate to 28%.

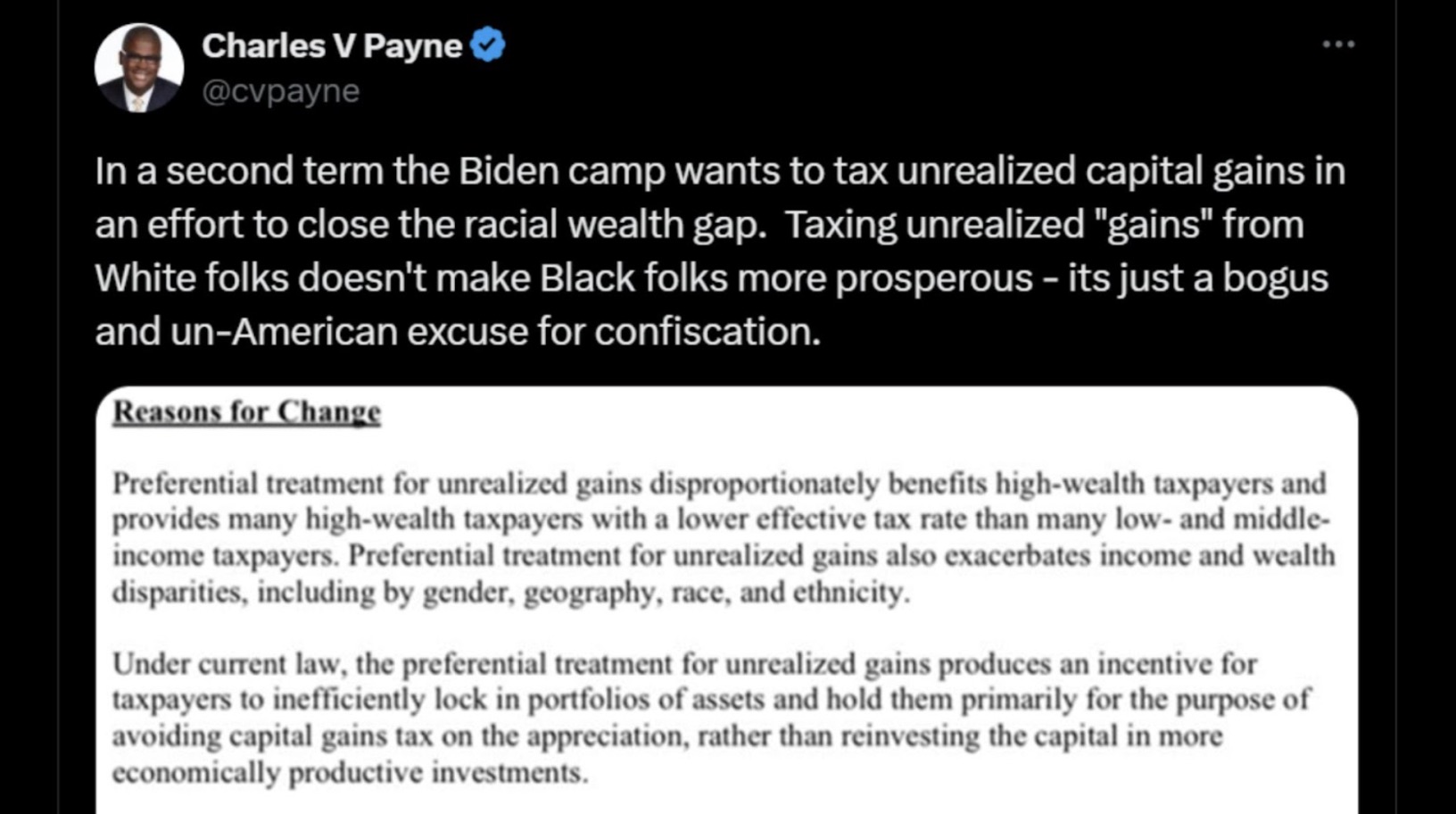

Many Have Slated Biden’s Attempt to Reduce the Wealth Gap

While reducing the wealth gap between white and black Americans has been something Presidents have struggled with for decades, many aren’t happy with Biden’s plans to do so.

Source: @cvpayne/X

Many have taken to social media sites such as X, formerly known as Twitter, to slam the move, saying that it doesn’t specifically offer any support to Black Americans or other minority groups and is proposing a higher tax for the sake of it.

Black Families Own Less Compared to White Families

The racial wealth gap is prevalent in America, something the Biden administration is hoping to tackle if Biden gets a second Presidential term.

Source: @drjgoldblatt/X

Black families own 24 cents for every $1 a white family owns, while Hispanic families own 19 cents for every $1 a white family owns.

Taxes Are a Big Issue for the 2024 Presidential Election

There are several big issues for the 2024 presidential election, including taxes.

Source: Kelly Sikkema/Unsplash

At the end of his term, Trump had significantly reduced taxes, which he plans to extend should he win a second term. But Biden is clearly planning on raising taxes should he get a second term.

If Biden Becomes President

Biden outlining his tax plan for 2025 will only happen if he gets voted in to serve a second term as US President.

Source: The White House/Wikimedia Commons

This means that if he loses to Trump, these tax plans may never actually come into play, as it will be up to Trump to decide what happens next.